Repairing is the key to your tax treatment replacing destroyed appliances carpet and linoleum are an asset and depreciated 5 years.

Rental property carpet depreciation life.

But what is class life.

It is the mechanism for recovering your cost in an income producing property and must be taken over the expected life of the property.

Any residential rental property placed in service after 1986 is depreciated using the modified accelerated cost recovery system macrs an accounting technique that spreads costs and depreciation.

This applies however only to carpets that are tacked down.

You can begin to depreciate rental property when it is ready and available for rent.

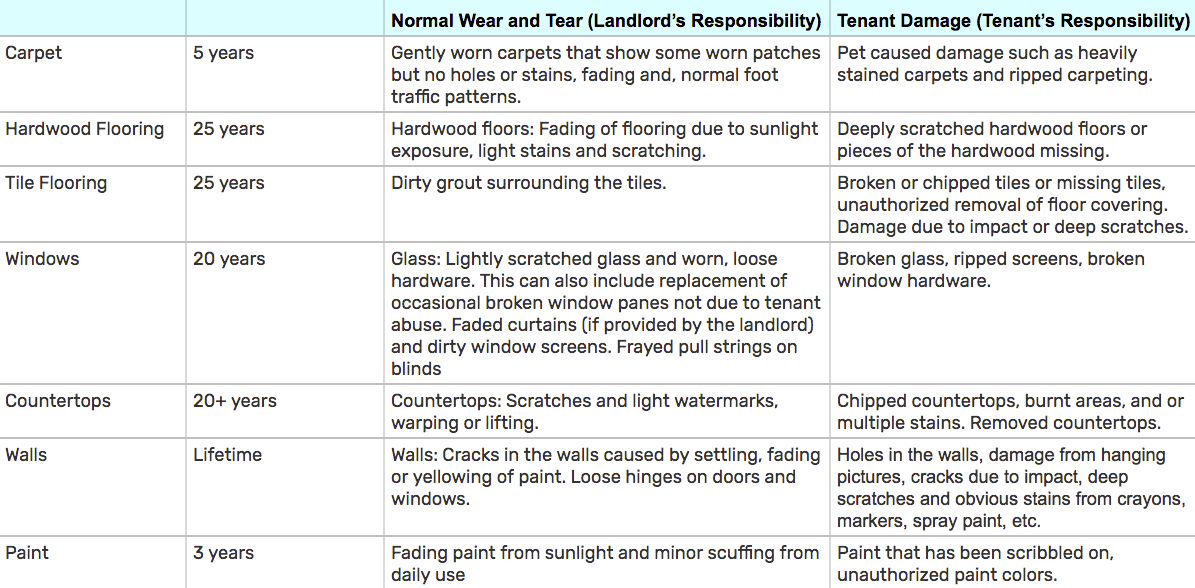

Normal wear and tear.

Carpet life years remaining.

Carpeting is depreciated over either five years or 27 5 years depending on how it is installed.

These types of flooring include hardwood tile vinyl and glued down carpet.

Depreciation is a capital expense.

If the carpet is tacked down it is classified as personal property and is depreciated over five years.

Most other types of flooring are depreciated using the 27 5 year schedule only.

100 per year age of carpet.

Expected life of carpet.

Since these floors are considered to be a part of your rental property they have the same useful life as your rental.

2 years 100 per year 200.

Thus if the class life of carpet e g is more than 4 but less than 10 years the landlord depreciates carpet over 5 years because it is 5 year property.

Most repair costs that are results of the tenant destructive actions are fully tax deductible in the year incurred.

The life expectancy of carpeting in a rental unit is 10 years.

20 year property 25 or more.

I definitions and special rules for purposes of this section 1 class life.

See placed in service under when does depreciation begin and end in chapter 2.

Value of 2 years carpet life remaining.

New windows and new plumbing.

But for anything else hardwood tile etc it should be classified as residential rental real estate and it will be depreciated over 27 5 years.

10 years 8 years 2 years.

Repairing after a rental disaster.

Original cost of carpet.

Like appliance depreciation carpets are normally depreciated over 5 years.

The tenant damaged the carpeting by spilling kool aid and cooking oil throughout and in the spots where there are not stains there are cigarette burns as the tenant used the carpet as an ashtray.